One of the governments initiatives to put small business first and reduce their tax burden is coming to an end. If you are planning to purchase some large assets (less than $20K per asset), there is a considerable tax benefit to do it before June 30 2017.

One of the governments initiatives to put small business first and reduce their tax burden is coming to an end. If you are planning to purchase some large assets (less than $20K per asset), there is a considerable tax benefit to do it before June 30 2017.

If you haven’t heard of this initiative, here it is, businesses with an annual turnover of less than $10 million will have access to “simplified depreciation rules, including immediate tax deductibility for asset purchases costing less than $20,000 until 30 June 2017”

Case Study

Edna owns a company, Edna Pty Ltd, through which she operates three cafes across Victoria. Edna Pty Ltd has an aggregated turnover of $3.6 million and a taxable income of $180,000 for the 2016-17 income year.

Half way through the year, Edna utilitsed finance to purchase three new freezer units at a cost of $4,000 each and three new coffee machines at a cost of $11,000 each, exclusive of GST, for her cafes.

Edna Pty Ltd would also be able to claim an immediate deduction for each freezer and coffee machine purchased, giving an immediate deduction of $45,000 in the 2016-17 income year.

Benefit

Having access to the small business tax concessions will result in Edna Pty Ltd receiving a cash flow benefit of over $14,000. In addition, Edna Pty Ltd will have access to a range of other small business tax concessions.

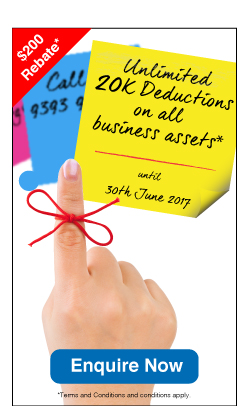

From now until June 30 2017, we will be super charging the government initiative by offering a $200 rebate on establishment fees for any asset finance transaction settled before June 30. This not only allows you to buy assets that were previously not affordable, but also bring your tax deduction forward to be claimed before June 2017. If you have any requirements to purchase new/used assets for your business, please follow the link below and one of our finance specialists will be in contact with you, or alternatively contact us directly on 9393 9600.